vermont sales tax food

Lowest sales tax 6 Highest sales tax 7 Vermont Sales Tax. Tax computation must be carried to the third decimal place and.

Home Of The Best Mustard Ever Stowe Mercantile New England

Vermont Sales and Use Tax Sales Tax.

. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. The total tax rate might be as high as 7 depending on local governments. Average Sales Tax With Local.

The state sales tax rate in Vermont is 6 but you can. Sellers should collect Vermont Sales Tax on TPP delivered to destinations. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Are groceries taxed in Vermont. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants.

An establishment that has made total sales of food or beverage in the previous taxable year of at least 80 taxable food and beverage. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. PA-1 Special Power of Attorney for use by Individuals Businesses Estates and Trusts.

9741 13 with the exception of soft drinks. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1. But there is endless justification of.

974113 with the exception of soft drinks. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1.

The type of sales and amount of sales determine if a business is a restaurant. Vermonts latest tax restructuring proposal addresses neither of these concerns -- it offers no substantive plans to fairly redistribute sales taxes on food. Are groceries taxed in Vermont.

Are excise taxes included in the Vermont sales tax basis. To determine tax due multiply the sale amount by 9 or 10 if the sale is subject to local option tax and round up to the nearest whole cent according to the following rules. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants.

This means that an individual in the state of Vermont purchases school supplies and books for their children. Round the tax to a whole cent. What is sales tax on food in Vermont.

An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale. If the third decimal is greater than four round up. Meals and Rooms Tax Return.

To learn more see a full list of taxable and tax-exempt items in Vermont. A new establishment that projects its total sales for the first year to be at least 80 taxable food and beverage Note. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Excise taxes are separate levies added by many states to the price of commodity items such as alcohol gasoline etc.

294 rows 2022 List of Vermont Local Sales Tax Rates. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. The Alcoholic Beverage Tax is 10.

9701 31 and 54. What is not included are federal excise taxes added to customer telecommunications service bills. In the state of Vermont they are exempt from any sales tax but are considered to be subject to the meals and rooms tax.

In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Computing Vermonts retail sales tax of 6 percent. This page describes the taxability of clothing in Vermont.

What is included are taxes that were applied before the retail sale. 974113 with the exception. What is the food sales tax in Vermont.

Restaurant meals may also. The maximum local tax rate allowed by Vermont law is 1. Application for Refund of VT Sales and Use Tax or Meals and Rooms Tax.

A restaurant is defined as. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Effective July 1 2015 soft drinks are subject to Vermont tax under 32 VSA.

For example if the tax you owe is 24443544 the tax is 2444355. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It should be noted that any mandatory gratuities of up to 15 and all voluntary gratuities that are distributed to employees are not considered to be taxable.

When making tax computations carry the decimal to the third place. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. The Vermont Meals and Rooms Tax is 9.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. What is food tax in Vermont. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

If not round down to the nearest cent. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when combined with the state sales tax. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

2022 Vermont Sales Tax Table. Vermont Meals Tax Exemption Certificate for Purchases of Meals For Resale. In comparison to local-level tax rates in other states Vermonts other local-level tax rates are highly complex.

Sales tax is destination-based meaning the tax is applied based on the location where the buyer takes possession of the item or where it is delivered. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. The current state sales tax rate in Vermont VT is 6.

Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Souvenir Creamer 1959s Souvenir Vermont Hermit Thrush Bird Etsy Vintage Hat Boxes Creamer Vermont

Vermont Sales Tax Information Sales Tax Rates And Deadlines

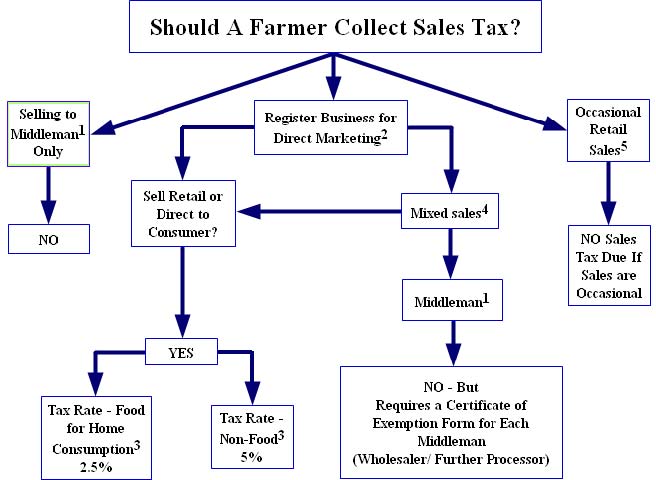

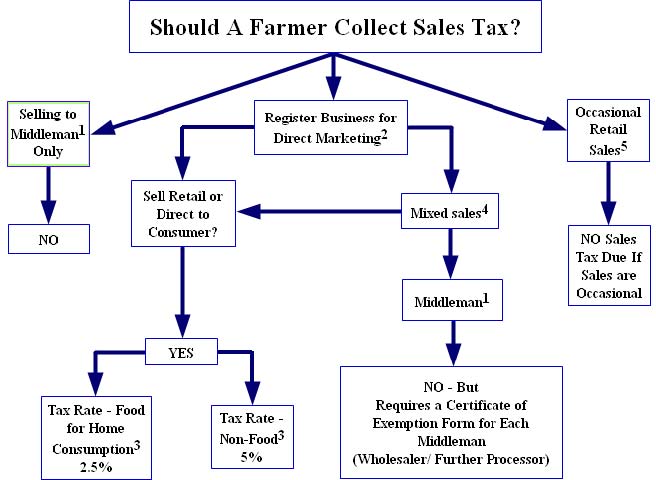

Direct Marketers And The Virginia Sales Tax

Flush States May Exempt Food From Sales Tax

Sales Tax On Grocery Items Taxjar

Wheatfields Bakery And Cafe 904 Vermont Street Lawrence Ks Eat Local Cafe The Good Place

Home Of The Best Mustard Ever Stowe Mercantile New England

Vermont Sales Tax Small Business Guide Truic

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes