us exit tax rules

Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US. Tax on individualsthe Exit Tax Americans have to pay when they give up their US.

Exit Tax Us After Renouncing Citizenship Americans Overseas

Net capital gain after an exemption from the deemed sale is taxed immediately.

. How is exit tax calculated. Exit taxation Provisions in the draft bill for amendment of the Corporate Income Tax Act CITA aim to transpose the rules for exit taxation described in Art. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance.

The general proposition is that when a US. Any appreciation in excess of 690000 as of 2015 will be subject to the exit tax. Green Card Exit Tax 8 Years.

Citizens who expatriate in 2020 there may be IRS exit tax consequences. Gift tax return or the estate timely files a US. What is the US.

Through the FEIE US expats can exclude up to 107600 of their 2020 earnings from US income tax. With the introduction of FATCA Reporting increased aggressive enforcement Foreign. Instead exit tax is an attempt by the US government to consolidate your US tax affairs.

Green Card Exit Tax 8 Years Tax Implications at Surrender. All property that is valued and treated as sold is then subject to taxation on the difference of the propertys fair value less the original cost. Exit taxes are relevant because some taxable income such as capital gains on home ownership is not taxed until you dispose of the asset.

US Exit Tax Taxation Under Section 877A As provided by the IRS. If you are a covered expatriate in the year you expatriate you are subject to income tax on the net unrealized gain in your property as if the property had been sold for its fair market value FMV on the day before your expatriation date mark-to-market tax. For some that means being charged an exit tax on your income in your last year of citizenship or residency.

But the rules are not limited to. The exit tax rules impose an income tax on someone who has made his or her exit from the US. The exit tax rules apply to citizens and Legal Permanent Residents Green-Card Holders who qualify as LTR Long-Term Residents.

The proposed provisions will extend the scope of taxable transfers of assets between different parts of the same entity. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. However in any of the following circumstances the taxpayer may defer the payment of the exit tax subject to interest in line with the provisions of the Income Tax Management Act ITMA by paying it in instalments over five years.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. The covered expatriates property for purposes of the exit tax is that property that would be taxable as part of the expatriates gross estate for federal estate tax purposes and is generally valued in the same manner as if he or she had died on the day before the expatriation date as a citizen or resident of the United States Notice 2009-85. This exclusion applies to foreign earned income only.

However US citizens are automatically liable to expat laws surrounding taxation and as a result are subject to exit tax rules. Legal Permanent Residents is complex. Estate tax return and pays any tax due.

This determines the gain on your assets as well as the taxable amount of this above. 5 of Council Directive 20161164 of the European Union ATAD. If you are a covered expatriate the first 699000 of gain is shielded from the Exit Tax for 2017 expatriations.

Real property the tax can actually be assessed twice. The tax calculation must be. And 2 the deemed distribution of IRAs 529 plans and health savings accounts taxed at ordinary income rates.

In direct answer to Ms question you will pay tax once and once only when you exit the United States. For spouses who expatriate each spouse files a separate Form 8854 and each spouse. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

In 2019 the maximum was 105900. The donee can avoid being taxed if the covered expatriate timely files a US. Youre allowed to exclude 627000 as of 2010 of that so the amount subject to tax will be 1373000.

Status they are subject to the expatriation and exit tax rules. When you renounce your US. This is a substantial amount and can be devastating if not handled correctly.

In some cases you can be taxed up to 30 of your total net worth. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

Citizen renounces citizenship and relinquishes their US. The Exit Tax Planning rules in the United States are complex. In most cases it will be in one giant lump in the year that you give up your US.

The IRS Green Card Exit Tax 8 Years rules involving US. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. For Green Card Holders and US.

Where a covered expatriate gifts or dies owning US. Exit tax is not charged out of mean-spiritedness or as a final grab at your personal assets. The exit tax shall be paid by not later than the companys tax return date in such a manner as may be determined by the Commissioner for Revenue.

Gift or estate tax can also be imposed on the donor eg. The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation. To clarify this is not a separate or an additional tax.

The actual tax you have to pay is whatever tax would apply if you actually had sold the assets the day before expatriation. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. If you are covered then you will trigger the green card exit tax when you renounce your status.

Citizenship or decide to give up your Green Card you need to tie up loose ends with the IRS by ensuring youre all paid up on your US. The IRS adjusts this amount each year for inflation although the Trump tax reform in 2017 changed the inflation index to a slower-growing index. Citizenship or green card.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

Green Card Exit Tax Abandonment After 8 Years

The Golden Ratio Multiplier Golden Ratio Investment Tools Ratio

If The U S Were To Exit Nafta North American Free Trade Agreement The Price You Pay For Most Foodstuff At The Grocery Store Woul Global Market World Global

An Introduction To What Are Compliance Laws Directive Principles Exit Strategy Legal Advice

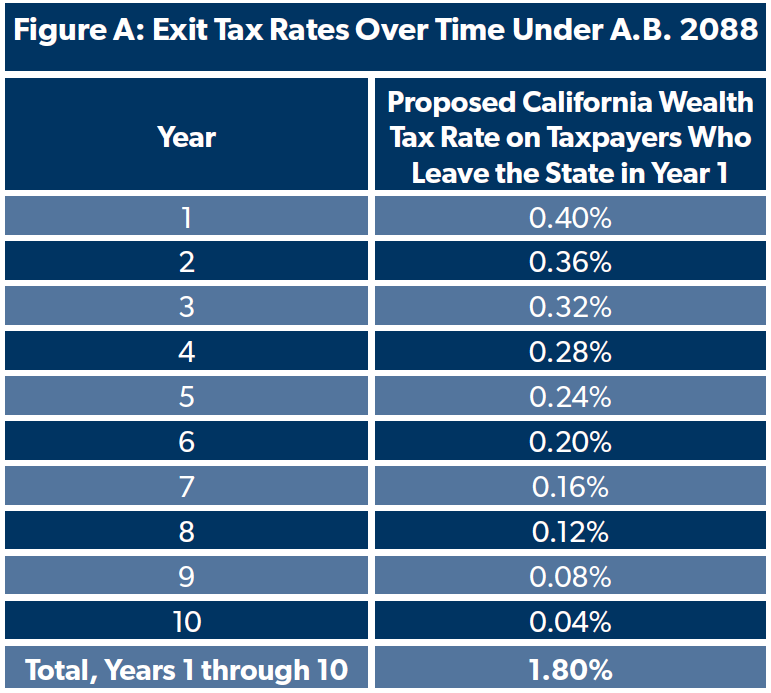

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Infographic 9 Step For Beginner Property Investors Wma Property Property Investor Investment Property Rental Property Management

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Renounce U S Here S How Irs Computes Exit Tax

Using I Bonds High Interest Rate To Hedge Against Inflation Savings Bonds Interest Rates Bond

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Advice From Our Founder Who Says You Often Don T Even Need A Lawyer Be Open And Honest And Try To Work It Out With Us I In 2022 Divorce Lawyers Exit

Exit Tax Us After Renouncing Citizenship Americans Overseas